- #YOU NEED A BUDGET APP HOW TO#

- #YOU NEED A BUDGET APP FULL#

- #YOU NEED A BUDGET APP SOFTWARE#

- #YOU NEED A BUDGET APP FREE#

#YOU NEED A BUDGET APP SOFTWARE#

Well provide 1:1 email support, online workshops, in-person kickoffs, and award-winning software to get your employees well financially. YNABers dont pay late fees, set up savings on autopilot, and spend about 1 hour each week managing their finances (and well!).

Almost half of your team is spending more than 12 hours each month dealing with personal finance stresses. YNABers always pay their credit cards in full. 30% of your team is using credit cards to pay for monthly necessities they cant otherwise afford. YNABers dont overdraft their bank accounts, and they never ask for paycheck advances. The #1 cause of employee stress, year after year, is their personal finances. In less than four months, your employees will be living a month ahead of their bills (verses a month behind). 70% of your team is living paycheck to paycheck.

We provide award-winning software to implement our method. Your team will break the paycheck to paycheck cycle, get out of debt, and save more money. You Need A Budget (YNAB, we call it why-nab when were in a hurry) teaches your employees a whole new way of thinking about their money.

#YOU NEED A BUDGET APP FULL#

To see our full methodology, check out our full budgeting app ranking. We also took into consideration each app’s design, intuitiveness and ease of use. Those features included: automated suggested budgets, auto-categorization of transactions, the ability to connect with various accounts, price and more. While using each app, we noted whether it offered various features and, if it did, how good those features were. To pick Best Budgeting Apps, we selected and downloaded 18 apps based on customer reviews and our own discussion with five financial planners. Our budget app methodologyīefore the review process, we spoke with five certified financial planners about budgeting If you’re a first-time budgeter or someone who doesn’t have the patience to use your budgeting app nearly every day, Mint is probably the way to go. Using YNAB is time-consuming, so it can be hard to turn it into a habit. It took an email to YNAB’s support team for me to realize the reason my credit card transactions weren’t appearing was because I’d missed a step when linking my card to the app. OTTAWA The Liberals have rejected a policy resolution that would have called on them to make a balanced budget part of their next election platform. It can be tricky to link your various bank accounts to the app.

#YOU NEED A BUDGET APP FREE#

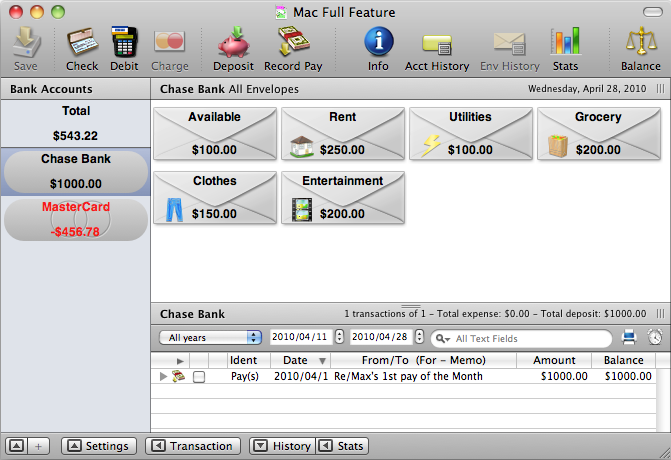

If you’re looking for a lower-price alternative, try Mint, which offers a free basic version or a premium version that costs $34.99 annually. You Need a Budget: This app is designed to help you get out of debt and stop living paycheck-to-paycheck but it takes a long time to set up, has an elaborate interface, and costs 11.99 per month. YNAB’s $98.99 annual price tag makes it one of the pricier budgeting apps. If you use a credit card for a transaction, you can mark it as such, and YNAB will automatically designate this amount for your next credit card payment. The app helps ensure you can make your credit card payments each month. If this happens, a prominent “Overspent Categories” banner appears at the top of the home screen click it and you’ll be able to transfer surplus cash from another category, The bar turns red if you’ve already exceeded your spending limit, for a given category, which helps you know well in advance if you don’t have enough money to cover all your expenses. Each category has a progress bar that starts yellow and transitions to green when it’s fully funded with cash. YNAB only allows you to allocate money you already have, which makes it difficult to go over budget. Adding cash transactions is simple thanks to an “Add Transaction” button that offers a searchable list of every vendor you’ve ever paid. As previously mentioned, you can look for coupons for items like eggs and butter to help bring down the cost of items most impacted by inflation. But this can be a virtue: You’ll see where every dollar of your income goes at the start of each month, which will force you to be more mindful about your spending.

YNAB (You Need A Budget) is great for people who share their spending with a partner.

#YOU NEED A BUDGET APP HOW TO#

You need to take action on every transaction by assigning it to its specific category. Budget apps can be a great tool for learning how to save money. You can enter upcoming bills and their due dates and indicate whether they get paid monthly, quarterly or eventually, a distinct feature that gives YNAB an advantage over similar apps. Cash transactions can be easily recorded as well. Connect the app with your credit card account and it will record your purchases. You’ll fill the buckets with cash each time you get paid. When you first get started with YNAB, you’ll plan out your monthly expenses in detail by creating spending buckets for each category, such as groceries or travel.

0 kommentar(er)

0 kommentar(er)